In the wake of COVID-19, will daytime experience a resurgence?

By Christine Formenti and Katie Jordan Green from C-K’s Strategic Audio Video Investments (SAVI) Team

We are in unprecedented times. COVID-19 has and will affect the TV landscape in ways we never saw coming. With social distancing in place, we are witnessing massive changes to how people live their daily lives which includes TV viewing habits. Nielsen has already seen large increases in viewership in South Korea and has seen similar viewership changes over the years during times when people needed to stay home.

Droves of people are now telecommuting. Nielsen reports that remote workers connect with traditional TV three hours more each week compared to non-remote workers. Streaming times will also surely increase. But, unlike TV which can be simply be on in the background, platforms often require more engagement (i.e. selecting programs) rather than on as background filler. Could the days of TV marathons be making a comeback? Data from Samba TV show there is already a surge in daytime viewership, with a 16% increase when comparing Monday to Monday.

Key Takeaway – As consumers are forced to stay in their homes, they will look to TV to occupy their time. With this increase of viewership, new advertisers may want to take advantage of efficient pricing before stations and networks inflate rates. This may also be an opportunity to reach consumers you may have never been able to reach in the past due to budget limitations, with ratings increasing in less expensive dayparts.

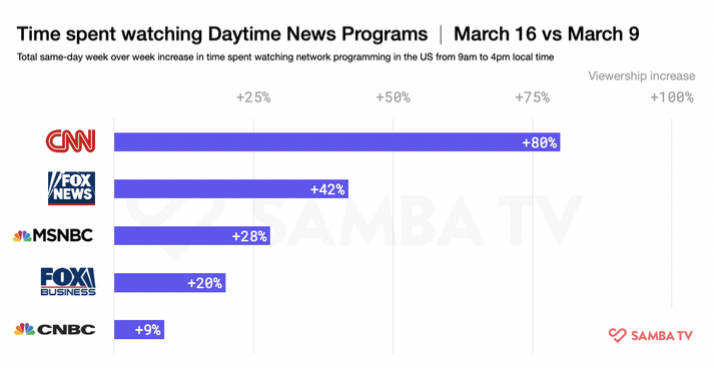

With all live sports suspending or cancelling their seasons, this will change what people are now watching. Several sporting events normally would be happening during daytime hours (golf, March Madness, baseball), and now networks are filling those programming slots with something viewers may not want to watch. This may drive viewers to look to other programming to fill their time. According to Samba TV, there has been a swell of eyeballs across all national news networks, especially CNN.

Key Takeaway – As one live-viewing event has subsided, another has taken shape. According to the VAB, we have already seen this shift happen in the news viewership over the last several years. The report indicates these changes have come about regarding news and politics. When we look at the here and now, people are tuning in for live updates from the CDC, the President and other prominent figures to understand how the pandemic is affecting them locally, nationally and globally. As brands look to remove dollars from sports networks, they may want to look at news, which is a similar viewing experience of live, lean-in programming. When making these shifts, advertisers and agencies need to take into consideration impression differences between sports to news, ensuring they are receiving equal value.

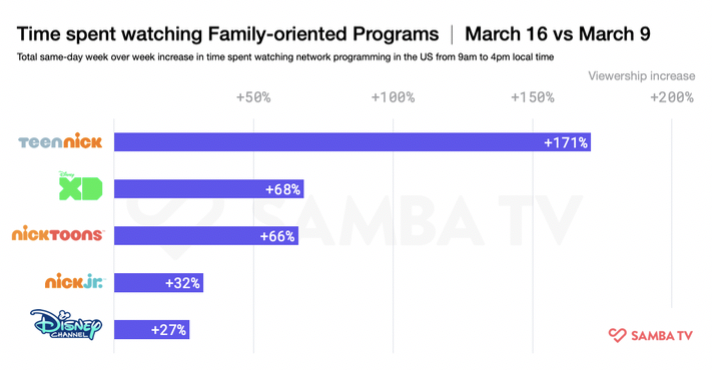

Children and young adults are home from school, and hopefully they are armed with the tools they need for e-learning. The anticipation would be these children and young adults will spend their time still learning, but without the supervision of teachers, professors and parents, those hours may start to bleed into other activities, like watching TV. Also, as parents are forced to work from home, they may not have the capabilities to monitor e-learning; children and young adults may be pushed toward TV watching. There have already been reports of increases across children-friendly networks like Cartoon Network, Disney Channel and Nickelodeon. Samba TV data also shows similar growth changes.

Key Takeaway – While there is a surge in children-focused networks, this is not necessarily a place that every advertiser can move into. If anything, this shows that children are still leaning into linear TV and not only watching programming on streaming platforms or devices.

How will brands be affected by daytime viewership increase? How should they respond?

Brands may see over-delivery on their plans in daytime and a whole new set of consumers they did not anticipate reaching. As plans are built off estimated ratings based on historical data, no one could have foreseen this coming. Therefore brands that already have schedules placed will reap the benefit. Another benefit is the potential to reach consumers they may have only had a chance to engage with in higher priced dayparts like Prime. This could result in increased reach and frequency on an audience they had lower expectations for. In any case, brands that are already in daytime are getting more bang for their buck in the weeks to come.

As we continue to weather the COVID-19 storm, we will see more overarching detail on the impact of daytime ratings. Buyers and planners should work closely with their brands to determine if adjusting campaigns into daytime would lead to brand success. There is still strong viewership across other dayparts, so moving dollars out of some solely to support a surge in another is not recommended. Review your daypart rotation and stay on top of viewership trends in the coming days and weeks.

Looking forward, what do we need to consider for 2021 campaigns?

Once COVID-19 is behind us, we would presume daytime ratings would return to their traditional levels. Buyers and planners will need to remember the March/April 2020 rating books will be an anomaly for daytime ratings, and all other dayparts as well. We should expect a radical change to ratings in the back half of the year as well. Between the re-introduction of sporting events that were suspended or postponed (MLB, NBA, NHL, PGA, Olympics, etc), regularly scheduled sporting events starting (NFL, NCAA Football), and season premieres/new programming – not to mention political pressure – we will be in store for viewership competition like no other. 2020 will be an unconventional year of ratings!

More Insights

- March 13, 2020 How COVID-19 is impacting culture and consumer behavior: March 9 – 13.

- March 10, 2020 Politicians can’t give a straight answer, but we can still learn a thing or two.

- February 28, 2020 Google Chrome browser privacy updates.